Regulatory Framework for Business Transactions - Short Quiz 1

Regulatory Framework for Business Transactions - Short Quiz - Content

~16 min read

🎓 Listen to Professor Narration

Too lazy to read? Let our AI professor teach you this topic in a conversational, engaging style.

Overview

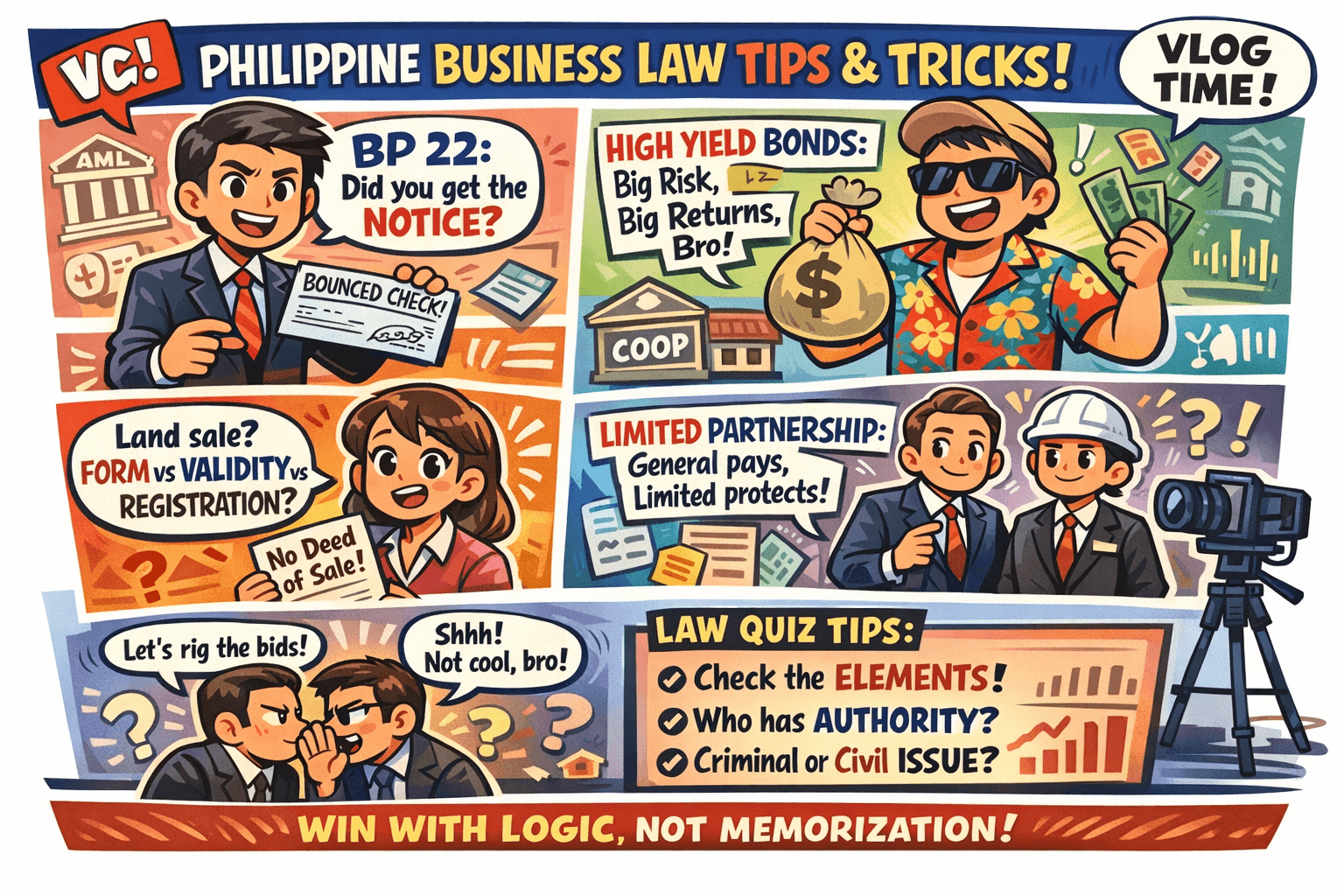

This quiz is built around real-world Philippine business-law scenarios: negotiable instruments (BP 22), corporate governance (audit committees, board vacancies, amendments to Articles), partnerships (especially limited partners and liability), contracts and registration (sale of land and formal requirements), market integrity (bid-rigging), and regulated sectors (cooperatives, banking, AMLA). In this “vlog-style transcript,” we’ll zoom out from the multiple-choice format and focus on the rules, the logic behind them, and the step-by-step way to analyze each fact pattern. By the end, you should be able to spot the controlling law quickly, classify the issue (criminal vs civil, internal vs external, form vs validity), and explain why a result follows—without relying on memorization.

Concept-by-Concept Deep Dive

BP 22 (Bouncing Checks): What Triggers Liability and How Prosecution Works

- What it is (2–4 sentences).

Batas Pambansa Blg. 22 penalizes the act of making or issuing a check that is later dishonored, typically for insufficiency of funds or a closed account. It’s designed to protect the integrity of checks as substitutes for cash in commerce. Exam questions often test not just “what BP 22 is,” but the procedural and evidentiary elements needed for prosecution.

Key elements you must always check (the “BP 22 checklist”)

- A check is made/drawn and issued to apply on account or for value (i.e., it’s used as payment or for consideration in a transaction).

- Dishonor upon presentment (e.g., insufficient funds, account closed).

- Knowledge of insufficiency at the time of issuance is often inferred by law through notice-and-failure-to-pay mechanics (see next).

- Written notice of dishonor is given to the drawer, and the drawer fails to pay or make arrangements within the statutory period.

Step-by-step reasoning recipe for BP 22 items

- Identify the instrument: Is it a check (not a promissory note, not an IOU)?

- Identify the reason for dishonor: insufficiency/closed account vs other reasons (e.g., irregular signature issues can change the analysis).

- Confirm notice of dishonor: prosecution commonly hinges on proof that notice was received (not just sent).

- Check the “cure period”: if payment/arrangement is made within the period after notice, criminal exposure may be affected.

- Separate criminal from civil: even when criminal liability is contested, civil liability for the underlying obligation may remain.

Common misconceptions and how to fix them

- Misconception: “BP 22 requires intent to defraud.”

Fix: BP 22 is generally treated as malum prohibitum—focus on statutory elements (issuance, dishonor, notice, failure to cure), not subjective deceit. - Misconception: “Dishonor alone automatically convicts.”

Fix: Many cases turn on proper notice and opportunity to pay; proof requirements matter. - Misconception: “Post-dated checks are exempt.”

Fix: Post-dating can be relevant to timing, but it doesn’t automatically remove BP 22 exposure.

High-Yield, High-Risk Corporate Debt: Understanding “Speculative” Bonds

- What it is (2–4 sentences).

Corporations can raise capital by issuing bonds, but bond quality varies widely depending on the issuer’s financial strength. Some bonds offer higher yields precisely because the issuer is riskier (e.g., heavily indebted, weak cash flow). The quiz is testing your ability to connect credit risk to the market label commonly used for these instruments.

Components: what makes a bond “high yield”

- Credit quality / probability of default: weaker issuers must pay more to attract investors.

- Yield spread: the extra return above safer benchmarks compensates for risk.

- Covenants and security: riskier bonds may include stricter covenants—or sometimes fewer protections, increasing risk.

Step-by-step reasoning recipe for bond classification questions

- Read the issuer description: financially weak, heavily indebted, needs capital.

- Connect issuer risk → investor compensation: higher risk → higher promised yield.

- Map to the market term: the finance world has a standard nickname for these.

Common misconceptions and how to fix them

- Misconception: “High yield means high quality.”

Fix: In credit markets, high yield often signals lower credit rating and greater default risk. - Misconception: “All corporate bonds are equally safe if registered.”

Fix: Registration/disclosure doesn’t eliminate credit risk; it just improves transparency.

Limited Partnerships: Who Pays When the Partnership Owes Money?

- What it is (2–4 sentences).

In a limited partnership, at least one partner is a general partner (manages and has broader liability), and at least one is a limited partner (typically contributes capital and has liability limited to contribution—subject to conditions). Exam scenarios often ask how to allocate liability to third-party creditors when the partnership is insolvent.

Core distinctions you must master

General partner

- Has management power by default.

- Has personal liability for partnership obligations (typically to the extent allowed by law), meaning creditors may pursue the general partner if partnership assets are insufficient.

Limited partner

- Usually does not manage day-to-day operations.

- Liability is generally limited—often up to the amount contributed (and sometimes agreed additional contribution), provided they don’t act in a way that legally exposes them as a “de facto” general partner.

Step-by-step reasoning recipe for “debts vs contributions” problems

- Classify each partner (general vs limited) from the facts.

- Compute the partnership’s deficiency: total debts to third persons minus partnership assets available for payment (if given).

- Apply the order of exposure:

- Partnership assets pay first.

- General partners are typically next in line for the unpaid balance.

- Limited partners’ exposure is usually capped and depends on contribution status and compliance with limited-partner restrictions.

- Check if the limited partner “crossed the line”: did they participate in control/management in a way that triggers broader liability?

Common misconceptions and how to fix them

- Misconception: “Limited partners never pay anything beyond their capital.”

Fix: They can be required to fulfill agreed contributions, and certain conduct can increase exposure. - Misconception: “All partners share losses equally.”

Fix: Loss-sharing depends on the partnership agreement and the partner type; third-party creditor rights follow statutory rules and liability structure.

Corporate Governance Mechanics: Audit Committees, Stockholder Rights, and Amending the Articles

- What it is (2–4 sentences).

Corporate law questions often test who has authority (board vs stockholders), what approvals are needed, and which committee does what. Publicly listed companies also follow governance standards that assign specific oversight duties to the audit committee—especially around financial reporting and internal controls.

Audit committee: what it typically does (and doesn’t)

- Typically does: oversee financial reporting integrity, coordinate with external auditors, review internal controls and risk management related to financial reporting, monitor audit independence, and ensure audit findings are addressed.

- Typically does not: run daily operations, replace management’s role in preparing financial statements, or make executive decisions that belong to management or the full board.

Reasoning tip: If a choice sounds like management’s job (operating the business) or the full board’s strategic job (major corporate acts), be skeptical that it’s an audit committee responsibility.

Amending the Articles of Incorporation (e.g., changing corporate name)

- Changing foundational corporate information is usually treated as a major corporate act.

- Expect a two-layer approval structure: board approval plus a stockholder vote threshold, followed by regulatory filing/approval with the appropriate government office.

Step-by-step recipe for amendment questions

- Identify if the change is Articles-level (name, purpose, term, capital structure, etc.) vs bylaws-level.

- Determine internal approvals (board + stockholders; check required vote threshold).

- Determine external steps (filing, approval, issuance of amended certificate).

Common misconceptions and how to fix them

- Misconception: “The board alone can amend the Articles.”

Fix: Many Articles amendments require stockholder approval and regulatory filing. - Misconception: “Audit committee = internal auditor.”

Fix: The committee oversees; it doesn’t personally perform audits like an internal audit department would.

Board Vacancies and Quorum: Resignations, Remaining Directors, and Proper Filling

- What it is (2–4 sentences).

Board action depends on having a valid quorum, and vacancies must be filled following the Corporation Code rules and the bylaws. Exam patterns include multiple resignations that drop the board below a typical majority, raising the question: can the remaining directors fill vacancies, or must stockholders elect replacements?

The two big questions to ask

- Is there still a quorum of the board?

Quorum is usually based on the number of directors as fixed in the Articles/bylaws, not merely the number still sitting after resignations. - What caused the vacancy?

The rules can differ depending on whether the vacancy is due to resignation, removal, expiration of term, or an increase in the number of directors.

Step-by-step reasoning recipe

- Start with the authorized number of directors (the full board size).

- Compute the quorum requirement (often majority of that full number).

- Compare it with the number of remaining directors.

- If quorum exists, determine whether the board can fill vacancies or whether stockholders must act (depending on vacancy type and governing rules).

🔒 Continue Reading with Premium

Unlock the full vlog content, professor narration, and all additional sections with a one-time premium upgrade.

One-time payment • Lifetime access • Support development

CPALE App and tools to supercharge your learning experience

CPALE Journal Entry Generator

Convert plain English transactions into accounting journal entries instantly. Perfect for accounting students and professionals. Simply describe a transaction like 'Bought supplies for $5,000 on account' and get the proper debit and credit entries.

Join us to receive notifications about our new vlogs/quizzes by subscribing here!